It’s been nearly six years since the Great Recession began and four years since the current economic recovery started, making it a good time to take stock of where small business stands.

The National Federation of Independent Business’s (NFIB)’s Small Business Economic Trends survey provides some clues. The overall message from the data is this: Small business is doing better than it was at the start of the economic recovery, but has not yet returned to pre-recession conditions.

The NFIB’s effort is the longest-running survey of small business owners. While it is not a representative sample – it covers only members of the NFIB – the number of topics it includes, and the length of the series, make it a valuable source of information about small business owners’ opinions.

I looked at responses to 21 questions that I think are most indicative of small business economic conditions. I focused on data gathered during three July surveys (to avoid issues of seasonality): in 2007 (before the Great Recession), in 2009 (when the recovery was just beginning) and in 2013 (now). I divided the questions into three categories – the current situation, access to credit, and views of the future.

Some of the measures are now close to 2007 levels, but not a single one has returned completely to prerecession levels. Most, but not all, are more positive than they were when the economic recovery began.

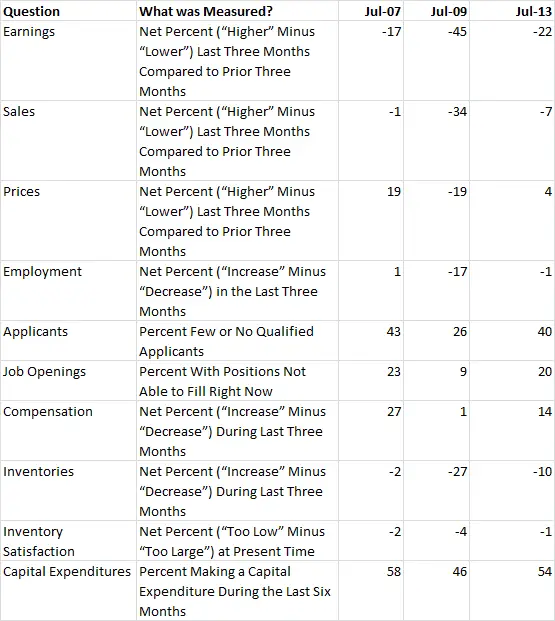

Table 1. Current Situation

Source: Created from data from Small Business Economic Trends

Consider the numbers in Table 1, which includes questions that assess the current situation of small businesses. The net percentage of businesses that reported having higher sales three months earlier was -1 in July of 2007. That is, one percent more businesses reported lower sales than higher sales for the April to June 2007 period than for the January to March 2007.

By contrast, when the recovery was just beginning in July 2009 the net percentage was -34. That is, 34 percent more companies reported lower sales than higher sales over the three months from April to June 2009 than for January to March 2009. This July, the net percentage was -7: a better situation than in 2009, but worse than in 2007.

Or consider the data on job openings at small businesses. In July 2007, 23 percent of companies had unfilled positions. In July 2009, that fraction was down to 9 percent. In July of 2013, the number was back to 20 percent – an improvement on 2009 but worse than in 2007.

Table 2. Credit Conditions

Source: Created from data from Small Business Economic Trends

Table 2 shows the responses to questions about access to credit. While a greater fraction of businesses reported having their credit needs satisfied in July 2013 than in July 2009 – 30 percent versus 28 percent – the more recent fraction remains lower than in July 2007 when it was 37 percent.

By contrast, the percentage of regular borrowers does not appear to have recovered at all. The share of companies borrowing at least once every three months fell from 36 percent in July 2007 to 33 percent in July 2009 and then fell again to 31 percent in July 2013.

Table 3. Views of the Future

Source: Created from data from Small Business Economic Trends

Table 3 shows small business owners’ views of the future. Responses to most of the outlook questions were more negative this July than in July 2007, though they are largely more positive than in July 2009. For instance, when asked if the next three months are a “good time to expand” only 9 percent said “yes” in July, compared to 16 percent in July of 2007 and 5 percent in July of 2009.

Similarly, back in July 2007, 23 percent more small business owners planned to increase hiring than decrease it. That number was much lower in July 2009 when 3 percent more small business owners planned to cut hiring than to expand it. In July 2013, the number was again positive – 9 percent more owners planned to add workers than lay them off – but it remained lower than in 2007.

In short, the NFIB data show that small business is doing better than it was when the recovery first began. The data also show that small business is not doing as well as before the Great Recession.

What the data don’t tell us is whether the recovery for small business is just painfully slow or whether small business will never again do as well as it did in 2007.

Road to Recovery Photo via Shutterstock

The post On the Long Road to Economic Recovery? You Decide appeared first on Small Business Trends.

via Make Your Own Website Tools Tips Tricks http://feedproxy.google.com/~r/SmallBusinessTrends/~3/TWzoHuYXTis/on-the-long-road-to-recovery.html Best WordPress Hosting

No comments:

Post a Comment